Each fall and spring for the last ten years Quilts, Inc., the company that owns Quilt Market, has published the attendance numbers for the show in their newsletter. Over the years that I’ve been reporting on the quilting industry, I’ve heard many people express skepticism about the accuracy of these numbers. Just last week I was talking about Quilt Market with an industry executive who said, his voice laden with sarcasm, “Oh sure, every show is a smash success.” I know that the attendance numbers are self-reported and they certainly could be inflated, but I choose to take them at face value. They are the only numbers we have and I think they do tell a worthwhile story of the way our industry trade show is changing.

A few years ago I thought it might be interesting to compile the Quilt Market attendance numbers and make a chart. With the help of some friends, I was able to find issues of the Quilt Market eInsider newsletter dating back to 2008. I contacted Quilts, Inc. to request data going back further because I thought it would be really fascinating to track the show’s attendance from its inception in 1979, but they denied my request.

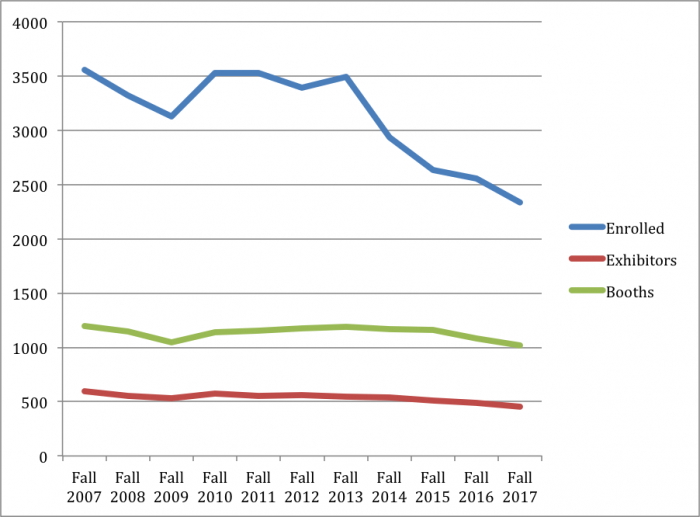

| Date | Enrolled | Exhibitors | Booths |

| Fall 2007 | 3558 | 593 | 1195.5 |

| Fall 2008 | 3321 | 551 | 1144 |

| Fall 2009 | 3131 | 535 | 1045.5 |

| Fall 2010 | 3531 | 572 | 1140 |

| Fall 2011 | 3531 | 556 | 1152 |

| Fall 2012 | 3395 | 559 | 1177.5 |

| Fall 2013 | 3496 | 547 | 1190.5 |

| Fall 2014 | 2933 | 537 | 1168 |

| Fall 2015 | 2634 | 514 | 1163 |

| Fall 2016 | 2557 | 487 | 1085 |

| Fall 2017 | 2336 | 454 | 1019 |

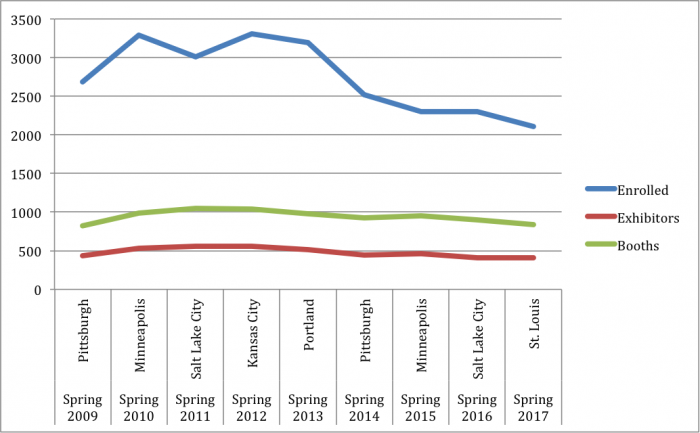

| Date | Location | Enrolled | Exhibitors | Booths |

| Spring 2009 | Pittsburgh | 2688 | 431 | 822.5 |

| Spring 2010 | Minneapolis | 3290 | 530 | 983 |

| Spring 2011 | Salt Lake City | 3009 | 559 | 1049.5 |

| Spring 2012 | Kansas City | 3311 | 554 | 1040 |

| Spring 2013 | Portland | 3195 | 512 | 975 |

| Spring 2014 | Pittsburgh | 2522 | 441 | 922.5 |

| Spring 2015 | Minneapolis | 2300 | 465 | 956 |

| Spring 2016 | Salt Lake City | 2302 | 411 | 899 |

| Spring 2017 | St. Louis | 2104 | 405 | 835.5 |

A few things affect the data. Just before Spring 2014 Quilt Market Quilts, Inc. tightened the credentials required to attend the show. This led to a decrease in attendance because consumers who were able to get into the show previously were no longer allowed. It didn’t affect the number of exhibitors or the number of booths, however. And Spring Quilt Market is harder to compare year over year than the fall show because of the venue shifts, but it does return to the same venue approximately every five years so some comparison is still possible.

Unfortunately, as of spring 2018 Quilts, Inc., is no longer publicly publishing show attendance numbers. I have those numbers because I requested them as a potential exhibitor, but I’ve been told by Bob Ruggiero, Vice President of Communications, that I am not allowed to share them publicly or online.

Anyone can see by looking at the data that Quilt Market is in a slow decline. And you can surmise by the fact that Quilts, Inc. no longer wishes to share this data that the decline continues.

I’ve compiled and shared this data because I firmly believe in the idea that you can’t manage what you can’t measure. This show is vitally important to our industry and it needs to change if it’s going to survive. As it stands now the chances that it will be financially viable to have two shows a year five years from now seems slim.

One thing that’s really striking to me about meeting new people in the industry is how the reaction to Quilts, Inc. is always the same. When the topic of Quilt Market comes up nobody ever says, “What an innovative company!” or “Wow, Quilts, Inc is really on the cutting edge!” Without fail, people roll their eyes and say something about close-minded leadership that’s stuck in the past.

The way that a company grows is by learning, seeing different perspectives, and being willing to look at things in a way they didn’t see them before. That can only come by surrounding yourself with people of diverse of backgrounds and with diversity of thought. Rather than hiding the data from the public, why not use this opportunity to bring people together to sit down and reinvent the show: trade show experts, shop owners, manufacturers, and marketers including bloggers and influencers. Retail is in flux, but people are still buying products. There’s a lot to learn and this show could be the nexus.

Quilt Market is a valuable component of our industry, even if it’s no longer the order-writing show it once was. Being able to analyze the data and fully understand the big picture helps all of us see what’s really happening and rethink the function of this event going forward. Unfortunately, beyond what we see here, that data is no longer available to us.

I know I’m young for a quilter, but I grew up in an age where we basically think we’re privy to data, at least data that’s not personal or private. The fact that Quilts. Inc both refused your request for data going back to 1979 and that they are no longer publishing new data shows me that they’re not happy about the trend but do not know what to do about it, so they hide it. That is a clear indication of a company that is not forward-thinking or innovative, and simply rests on the fact that it’s “too big to fail.”

The fact that they have denied access to bloggers / Youtubers / Instagrammers because they’re not “industry professionals” is another sign that they do not really understand the age of influencers, social media, and viral marketing. I really hope they wake up or that they get replaced!

“Industry professionals” badges are for businesses that are within the trade, but whose primary function is not the retail sales of quilting supplies and fabric. As long as you have a website “with a unique domain name” and a tax ID or business license you can apply for this credential.

What role these industry professionals could play once they’re at the show is another question. At the moment I would say they’re underutilized.

Thanks for reporting on this, Abby! As a millennial new to the quilting and sewing scene, I find this behavior from Quilts Inc disheartening to say the least. In this social media age, it’s easier than ever to get honest feedback and suggestions for improvement, but if Quilts Inc doesn’t want to listen they condemn themselves to irrelevance.

That’s really true. Imagine if they solicited feedback. Or openly asked for ideas. Or put people from different sectors in leadership roles. Or even just made themselves available for something as simple as a phone conversation. Think about all the ways a growing company learns new ways of thinking. That’s all available to Quilts, Inc.

I am going to leave a post in defense of the industry and market as a shop owner attending both fall and spring markets for 10 years. The decline on the charts that you posted also reflects a tightening of credentials for attendees – and a much needed one! Remember that Quilt Market is a to the trade only show and was being attended by many people who had no business being there. While this sounds harsh, I would see a long arm quilter (who has legit credentials) shopping at market with many of her friends that she brought along. I now have to prove employment with multiple documents when I bring employees. In addition, they are there to work – I assign them demos and schoolhouses to attend , as I am running a business. The decrease in attendance by limiting only those who have business there allows us to work market more efficiently. Even so, I am no longer able to get samples for my shop at sample spree as I could in the past and have had to interrupt a lot of socializing of designers in booths so I could get questions answered about the large collections I just ordered. I may sound old school, as I grew up in the trade show industry, but I take my visits to market very seriously and love every minute of it twice a year. As always, thank you for being an integral part of our world.

I agree with you that tightening credentials was likely needed. That change, however, had no effect on how many booths there are at the show, or how many exhibitors and both of those numbers at both shows continue to decline. As I mentioned in the post credentials were tightened just before the Spring 2014 show, yet attendance at both shows has continued to decline since then (and that trend holds true for the Spring 2018 show). So although it is often cited as an explanation for the downward trend, I don’t think it holds.

The changing role and nature of Sample Spree is a perfect opportunity for reinvention. At one time, Sample Spree was a time for brick-and-mortar quilt shop owners to purchase small cuts of new lines to take back to their shops and sew samples before the lines arrived. Although that may be one function it still serves, I would say it now serves many other functions that aren’t officially acknowledged. My bet is that creative minds from different sectors could make that event less frustrating, more productive, and perhaps more lucrative, too, for everyone involved if they were given the chance to reshape it.

No surprise given the observed persona of the organization along with similar experience in a completely different market (event sales are down over 50% while overall sales hold steady growth). They need to bring in someone with far fresher thoughts and ideas than they’re currently brewing.

Thank you by continuing to shed data-based light on the strategic implications of this rapidly changing industry. My perspective comes from 20 years of experience vending at large sewing and quilting shows across the country, ie. AQS, IQF, OSQS, including a few tries at market with my personally designed stamps and stencils. I vend at guild sponsored shows, which charge lower booth fees because they have large numbers of unpaid volunteers… which means there is not a level playing field in costs for promotors to put on a show. The declining trends experienced by many vendors have a variety of reasons, i.e.

1. Aging customer base (they already have several lifetimes of supplies)

2. Rising costs

3. Proliferation of shows by promotors trying to grow, resulting in market saturation.

4. Shift to on-line buying in the retail world.

5. Discounters

Which gets us to how to transition to the future. Fortunately, humans have the need to make things and be creative …which won’t change.

Quilt Market has an unique opportunity to help gather data from business owners (far beyond attendance numbers) and I hope they hear your wisdom. Your newsletter provides best practices, strategic thinking, and should be read by everyone in this industry.

About your fourth point, one question to think about is whether ecommerce shops want to attend trade shows. I think they do, but I think their business needs and challenges are different from brick-and-mortar retailers. What if the show were to better meet their needs, were to really welcome them and work with them?

Many of us vending at retail shows also sell through our websites, so I’m assuming your question refers to businesses which currently sell only via ecommerce?

Promoters are happy to sell booth space to anyone who can pay the booth fees, and offer products of interest to attendees. For someone considering becoming a vendor, additional costs include booth infrastructure, a vehicle to haul product(or shipping costs), travel /lodging/ food costs. Depending on margins (and we do not all have the same product margins or transportation costs), the question is whether ecommerce businesses can afford to do the shows. If they can, it’s a great opportunity to attract customers who might have never found them otherwise.

We sell to whomever … owe do try to avoid discounters ! but if a buyer comes to my booth @ market and says were online only it makes 0 difference how there treated in Anyway everybody at Amazon/Fab.com with one exception ? i know of Moda, If they pay the sale price , they are treated as equals Equilter etc.. 1/2 of the top 10 buyers from market for my co for last 3-5 yrs have been Online vendors . Im sure the same for most of the others so i realy do not get your plea for treat them the same or equal or ? That realy doesn’t make sense to me with the exception of the “customers” i see carrying their big sample spree buy with plans to open online store out of garage, spare room killing off another real true brick and mortar , or just cutting into real business with employees and a real business , Online check the hand , etc… good luck a slick wet screen very deceptive i have things online (A Palm tree for example,e ) appear beautiful , in person ???? not even close to same that screen looks soooo ….. I have been burned so many times from online, catalogs buys etc. top ones like Sundance even bait and switch Fabric is a feel hold touch item in my view but i sell the online world also like all my competitors I appreciate your comments just seems you see descrimination towards online vendors if so ? the perpetrators will be gone soon as the areas only growing Martin Hoffman / Hoffman Fabrics.

Hi Martin, Thank you for your comment.

Here is some feedback I heard from an Etsy shop owner who attended Quilt Market this fall. “We had several experiences on this trip that just made us feel very shunned,” she said. “Not welcomed at Quilt Market and in the industry. We had a vendor stop talking to us since we told him we sold on Etsy. Both classes we attended bashed Etsy sellers in their presentations, still very geared to the brick and mortar shops, even three years later than our first show. One wholesaler we talked to and were interested in adding their fabric to our shop made a snide comment when we told him we were on Etsy. Sadly we decided we won’t be attending any more Quilt Markets. I talked briefly to another gal who felt the same way about Market. Her first time and she did not have a good experience.”

So although you may be treating everyone the same, that’s not the case across the board. The courses offered at the show are geared toward brick-and-mortar shops who are adding ecommerce, not online native shops looking to grow. If you read the piece I wrote and linked to about how Quilt Market could cater to online retailers there are lots of ideas in there about how to draw them in and bring them to the show.

Great insight into a world I know very little about. You’ve given me a lot to ponder, per usual. 🙂 Thanks!

Thank you for a very informative post. I have a relatively new online shop and I attended the Fall 2017 and Spring 2018 quilt markets and felt they were markedly different from one another – your data supports what my gut was saying. I find market invaluable for my business; I don’t get the visits from fabric reps because I don’t have a brick & mortar location – market allows me to see all the things and to put faces with names, and I appreciate that in a world of digital relationships. One thing I noticed with the fall market was that I felt like I had seen the new lines for weeks before attending which causes me to wonder how long market will be a valuable experience; if I can see it all before I go, perhaps I can forego the travel expenses. In contrast, I felt the lines were kept under wraps much better for the recent Portland market and I liked it. I did wonder, however, if seeing all the new items well ahead of market contributed to a decline in attendance in Portland.

Sample Spree has been both exciting and a disappointment – I think it’s outright wrong for a shop to be able to take every FQ bundle of a line and in my mind, is contrary to the intent/spirit of the event. I quite enjoyed having an opportunity to shop the pop-up shops inside of market at both Houston and Portland; it was less frantic and allowed me time to make thoughtful choices about the lines I wanted to experiment with and vet through my customers.

I would like to see Quilts, Inc. give more consideration to online shops when setting up the learning events. For the most part, the seminars are directed to brick & mortar shops and lack (in my opinion) an informed series of offerings to address things such as the use of social media to grow a customer base, creating effective “in store” promotions in the online world, and opportunities to learn from those entrepreneurs who have been hugely successful in that space.

Thanks for your post; I appreciate your thoughtful, evidence-based perspective.

The e-insider lists fall 2018 at 2,500 and doesn’t mention other years, which led me to your article as I would assume an increase in enrollment would be reported.

Hi Afton, You can find my analysis here: https://whileshenaps.com/2018/12/analysis-of-fall-2018-quilt-market-attendance-numbers.html